MiCA, the new digital asset regulation applicable across the EU, introduces new best execution requirements for cryptocurrencies similar to those that apply to traditional assets under MiFID. What do these new requirements mean for banks and digital asset brokers? Can a provider still operate a single-broker policy and remain compliant with best execution under MiCA? In this article, we delve into the practical considerations for ensuring compliance with the new rule.

The EU’s landmark Markets in Crypto Assets Regulation (MiCA) has been eagerly anticipated and welcomed by many in the cryptocurrency industry. The regulation has been designed to bring more stability to the markets and better security and protections for investors, through a series of extensive requirements imposed on issuers of digital tokens, and crypto-asset service providers (CASPs).

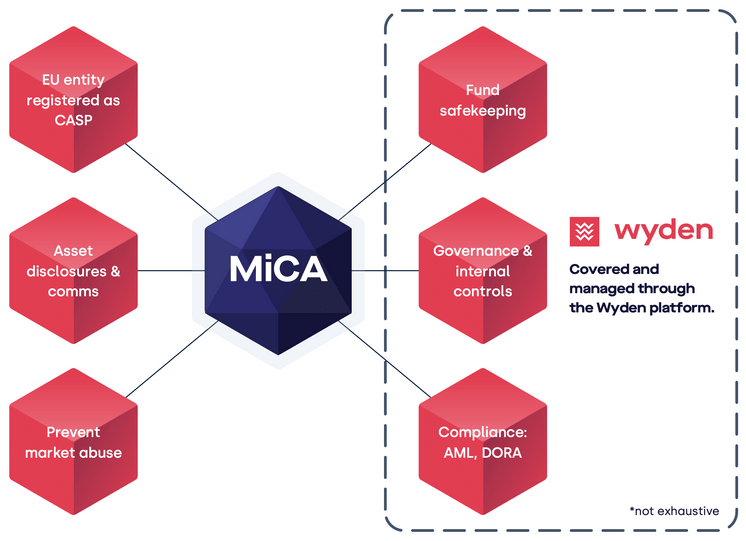

Summarizing MiCA’s new requirements for CASPs

The term CASP, as defined by the regulation, broadly encompasses any entity offering services such as digital asset custody, fund administration, trading, brokerage, or advisory services. The regulation introduces two types of requirements on CASPs.

General requirements cover all operators, which cover areas such as registration with the financial regulator of a member state, asset disclosures, and governance and internal controls. It also formalizes the requirements for CASPs to comply with other regulations, such as anti-money laundering laws.

Summary of CASP general requirements under MiCA

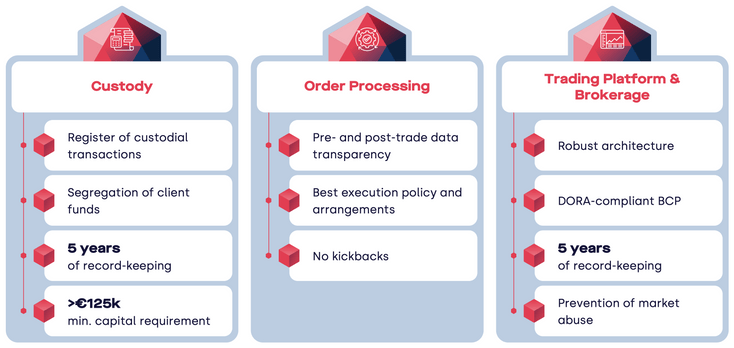

Service-specific requirements, covered in articles 75 to 82 of the regulation, refer to the types of services being offered. These include custodians, operators of trading platforms, and any entity processing orders on behalf of clients. In practice, the latter would encompass any banks offering digital asset trading, cryptocurrency exchanges, and brokers.

Summary of service-specific requirements under MiCA

Some of the service-specific requirements are relatively clear from an implementation perspective. For instance, custodians of digital assets must conclude a written custody agreement with clients and maintain a register of positions and transactions for a minimum period of five years.

However, the practical implementation of other articles is less concrete. Specifically, article 78 covers the execution of orders for crypto-assets on behalf of clients, stating:

“Crypto-asset service providers executing orders for crypto-assets on behalf of clients shall take all necessary steps to obtain, while executing orders, the best possible result for their clients taking into account factors of price, costs, speed, likelihood of execution and settlement, size, nature, conditions of custody of the crypto-assets or any other consideration relevant to the execution of the order. “

Further clauses establish the need for best execution arrangements, underpinned by a policy outlining the same, and ongoing monitoring to ensure effectiveness of the arrangements and demonstrate their compliance with the policy.

Challenges of best execution in the crypto markets

In the context of the digital asset markets, attaining best execution under all of the stated conditions comes with a particular set of challenges. One way to achieve best execution is to connect to multiple venues, seeking the best conditions across all factors. However, digital asset liquidity is notoriously fragmented across multiple jurisdictions and trading platforms, both centralized and decentralized. There is also a significant variation in platform costs and underlying network fees.

Another problem is the absence of standardized pricing methodology for digital assets. Combined with the volatility of the crypto markets, quoted prices can often vary between different exchanges and platforms. Price discovery is further impeded by a lack of centralized data sources that can act as a single point of truth.

MiCA’s best execution requirements echo those of MiFID; however, in one respect, MiCA goes a step further. ESMA has determined that the technical capabilities and execution speeds of crypto-assets can tolerate more stringent transparency requirements than traditional assets.

Therefore, MiCA mandates that pre- and post-trade data must be published within 30 seconds of execution, as opposed to a full minute for assets regulated under MiFID. These transparency requirements introduce an additional layer of complexity for banks connecting to multiple venues in an attempt to guarantee best execution.

Implications of MiCA: Achieving best execution in a single broker setup

Many banks may already operate a digital asset service, perhaps using a single broker setup to meet customer orders while avoiding the worst pitfalls of the crypto markets. This leads to the question: what are the implications of such a policy once MiCA is fully enforced starting from December 31st, 2024?

While ESMA has not issued guidance for this specific question under MiCA, such guidance does exist for the same question under MiFID. Therefore, it seems reasonable to assume that the relevant provisions of MiFID will also apply to MiCA.

The MiFID guidance does clarify the position regarding a single broker policy, stating that it may be reasonable under particular circumstances, such as where time or cost constraints would deliver a better result. Therefore, a single broker strategy should pass this “reasonableness” test, while meeting the other MiCA conditions – namely being provided for under the best execution policy and monitored for effectiveness.

However, a single broker strategy can only be compliant if the single broker is able to meet the conditions for best execution, which depends on their trading model.

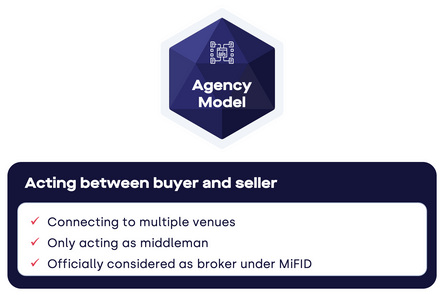

For the purposes of MiFID and MiCA, there is a distinction between brokers acting as agents routing orders via a third party – commonly referred to as agency brokers – versus those trading on their own account, known as a principal broker.

Agency brokers are considered as a broker under MiCA/MiFID and as such are also subject to best execution rules. Therefore, using an agency broker as a single provider may be compliant with MiCA.

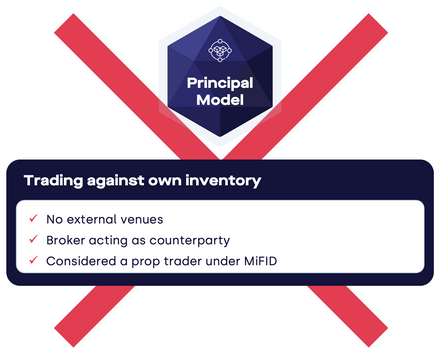

In contrast, a principal trade going through a principal broker doesn’t involve any external trading venues, since the principal broker acts as the counterparty to the trade. In this scenario, the principal broker is considered a prop trader under MiCA and is as such not subject to best execution rules.

However, a principal broker as a single service provider of choice for a bank or financial institution does not meet the best execution requirements under MiCA.

For the CASP to demonstrate best execution, multiple such principal brokers would have to be connected.

Given that the available guidance for best execution comes from MiFID, it’s possible that ESMA may issue more specific guidance for MiCA in the future. However, in the meantime, the existing guidance offers a pragmatic basis to implement best execution requirements in practice.

MiCA-compliant best execution with Wyden

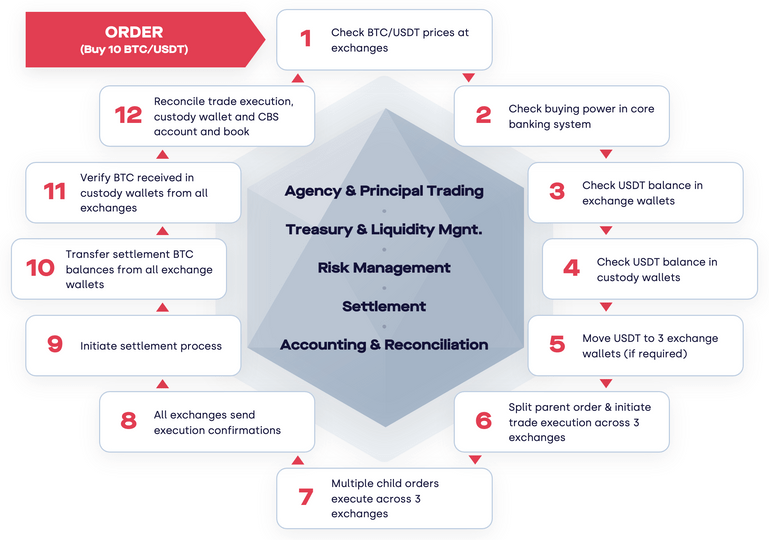

Wyden’s institutional trading technology supports banks and brokers with a fully MiCA-compliant digital asset offering. The key advantage of the Wyden platform is that it offers true best execution through market-wide connectivity to over +55 trading venues, and a smart order routing system that carries out prices comparisons and order splitting to achieve the optimal execution terms. Transparency is built into the system via real-time pre- and post-trade data, and Wyden’s standalone accounting system offers a fully auditable transaction trail.

Integration with custody partners such as Copper, Metaco, and Fireblocks, also means Wyden maintains an auditable record of transaction flows between custody and trading, with automated liquidity management solutions that ensure an uninterrupted trading experience. Core banking integrations with Temenos, Finnova and others ensure smooth reconciliation and support assimilation of a new digital asset offering into established workflows. Moreover, the Wyden system is flexible and scalable enough to support the future growth of our clients and the rapidly-expanding digital asset ecosystem.

Contact us today for an initial discussion about implementing a MiCA-compliant digital asset offering in your organization.

Please note that the above article does not constitute legal advice.